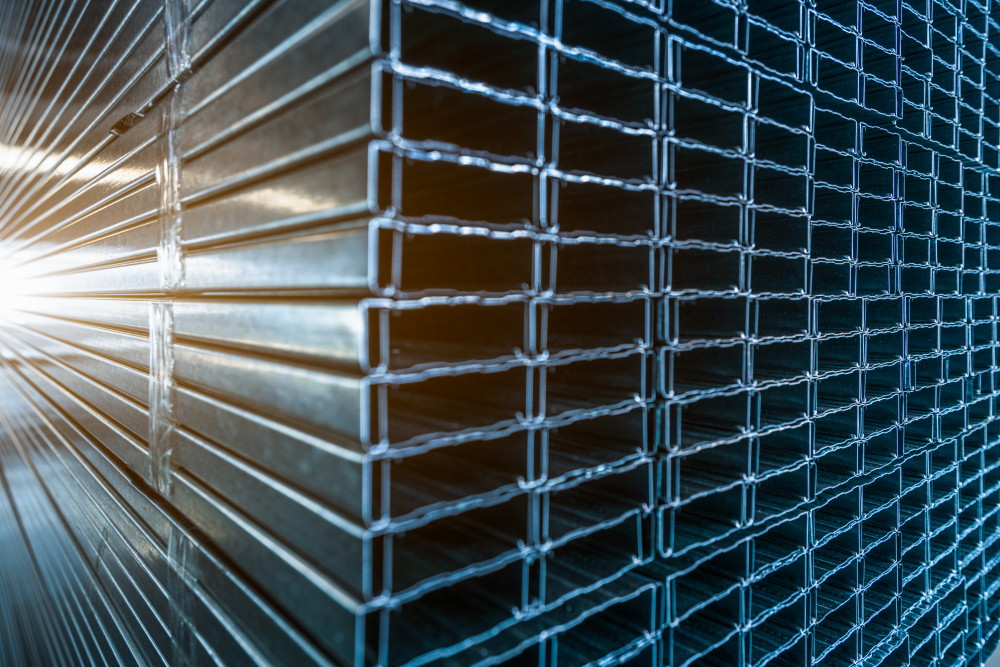

Understanding the tariff and tax landscape is needed for businesses looking into imported steel products in the Philippines. Most of the time, countries walk the tightrope between promoting international trade and taking care of industries at home.

The country faces this balancing act particularly with steel, a very much needed ingredient in several ongoing construction and infrastructure projects in the nation. Finding the right balance would ensure that the country can access affordable steel yet promote domestic steel production to support a more resilient economy.

The Tariff Landscape

The Philippines utilizes the ASEAN Harmonized Tariff Nomenclature (AHTN), which categorizes goods for tariff purposes. Steel products fall under various HS codes within the AHTN, each with its specific tariff rate. The Philippines follows a “Most Favored Nation” (MFN) principle, meaning the applied tariff rate is generally the same for imports originating from any WTO member country.

The average MFN applied tariff rate for non-agricultural products like steel is around 5.5%. However, this is just a general figure. Specific steel products may have higher or lower tariffs depending on factors like:

Level of processing

Often, raw steel materials are favored with the setting of the import tariff compared to other steel products. This policy encourages domestic manufacturing by making it less costly to import the base material and then process it into finished goods in the country.

This creates employment and uplifts the overall competitiveness of the steel industry within the nation. It should be noted that specific tariff rates will depend on the type of raw material and finished product, as well as the existing trade agreements the country has with others.

Competition with domestic producers

For instance, the country may introduce increased tariffs on imported steel products that directly compete with locally made alternatives in order to protect domestic steel producers. This protectionist approach seeks to level the playing field for Filipino companies, which are thus able to price their products competitively.

However, there are also certain drawbacks of such tariffs. Elevated import costs automatically translate to elevated prices for the consumers and businesses that consume steel. It may also limit innovation in the local steel industry due to reduced competition from foreign producers. In the.

Beyond Tariffs: Additional Taxes

Value-added Tax (VAT)

The country levies a 12% Value Added Tax (VAT) on imported steel. This tax isn’t assessed on the base price of the steel but on the total landed cost. Inclusive in the landed cost of an import is the customs value, any tariffs placed on the item, and additional fees or charges related to the process of the importation.

So, the government will get a tax contribution on that steel in a way that corresponds to the final cost of imported steel. Make sure to include this VAT in your import calculations so that you have a clear idea of the final landed cost for your steel products.

Internal Revenue Taxes (BIR)

Aside from the regular imposition of the Value Added Tax (VAT), the BIR may impose other kinds of taxes with regard to certain imported steel materials. The imposition of such taxes aims to exercise greater control over the steel market and to possibly increase government income. The nature of these extra BIR taxes and the rate differ for each specific steel product being imported.

Finding the Right Rate

Philippine Tariff Commission (PTC)

The Philippine Tariff Finder (PTF) is a useful tool for navigating the complexity of steel import taxes in the country. The Philippine Tariff Commission (PTC) maintains this online service, which serves as a one-stop shop for tariff information. Users can search for specific steel products by entering their Harmonized System (HS) codes, which are a worldwide defined system for categorizing traded goods.

The PTF then provides the tariff rate applicable to that specific HS code. This user-friendly tool simplifies the process of calculating import costs and guarantees proper customs declarations for your steel products.

Bureau of Customs (BOC)

But in the case of importing steel products into the Philippines, the website of the Bureau of Customs will provide an importer with a lot of information. It serves as a one-stop reference to all businesses and individuals for all types of customs procedures and the various tax regulations relating to imports.

It provides an outline of things to be done to clear customs and the difference between the many taxes imposed, so that users can be fully educated in their choices and the steps entailed to facilitate the import process. Further, the website will also update changes, if any, in customs regulations or tax structures from time to time. With that being a reference, one can go on the importation of steel with confidence, ensuring better customs experience.

Customs Brokers

Work with a licensed customs broker for a hassle-free steel import. Their expertise is very helpful since they can classify your steel product meticulously according to the Philippine Customs System to properly apply the tariff rate. Apart from that, they can properly calculate all the fees due, including taxes and any charges, so that there will not be any last-minute surprise at customs clearance.

Kay Takeaway

The country’s tariff rates may change from time to time. Updates on the matter can be readily accessed through the PTC and BOC websites. On top of that, trade agreements, such as the ATIGA, may provide for preferential tariff rates of steel products originating from member countries of ASEAN.

By understanding the intricacies of tariffs and taxes on imported steel products in the Philippines, businesses can make informed decisions, ensure smooth customs clearance, and navigate the nation’s steel trade landscape effectively.